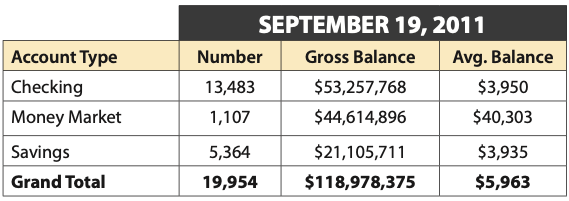

Background: This 10-branch, community bank in the southeast currently has $709 million in assets. Stellar Strategic Group originally partnered with this financial institution in 2011 to help grow core deposits.

Recently, we wanted to ramp up results for this client and offered to test two new strategies with our Deposit Direct program. The results are in and it has been a tremendous success.

Strategy Number One: Branch Specific Personalization (Postcard versus Letter)

Having relied on one creative version for all branches in the past, we tested two mail creatives (postcard and letter) with branch-specific variables to create a more personalized feel to the campaign. On the postcard, we utilized images of branch managers, along with the branch manager’s direct contact information. On the letter, we also included the images and contact information, as well as a personalized, handwritten note from the branch manager.

The goal was simple: Make the mail piece feel as if the branch manager was personally reaching out as the contact from the recipient’s closest branch location.

The piece that performed better was the letter. We experienced a 30% increase in response rates compared to the postcard. Having tested letter versions in the past, that had not been our experience. As the song goes, Times Are A-Changin’…and even more quickly in the world of marketing today. With increases in digital marketing efforts over the past few years, an old-fashioned, personalized piece of direct mail still makes an impression.

In addition to the increase in response rates, the letter also outperformed the postcard when comparing average balances by a factor of 172%. Despite leading with a Free Checking offer, the number of higher-end account opens increased by over 100%. Looking at both average balance and account type, the letter’s results showed a bigger appeal to a more affluent demographic.

Will we still utilize postcards? Yes. Postcards still offer a lower cost option than the letter package. We also believe that both the postcard and letter appealed to different demographics. Every market may not be the same, so testing both approaches initially for a specific market is our recommendation.

Strategy Number Two: Name Appends

For many years, appending names when addressing a direct mail piece caused issues with deliverability. Append rates were low and quality was even lower. Though not perfect, we were able to find a vendor that provided good append rates (60 – 70%) with consistent accuracy.

The second test we conducted was appending names to both the postcard and letter versions to see if we could get a lift by utilizing a name instead of a generic address line such as “Our Neighbor At.” The following results compared addresses with a name append versus addresses without a name append:

Lift in New Accounts: 140% – 236%

Lift in New Households: 133% – 317%

Clearly, the minimal additional cost to append names when available produced much better results compared to “Our Neighbor At” addressing. The bank did experience a small increase in the number of phone calls asking to be deleted from future mailing efforts. The lift by utilizing name appends more than made up for the small number of requests.

Even before we had actual response data from the tests, the feedback we got from our client was extremely positive. Compared to previous mail campaigns, our client reported they had never experienced so many prospects walking into the branch with the letter in-hand. And it wasn’t at one or two branches, but across all branch locations.

A Long-Term Growth Strategy

It’s not uncommon that we retain clients on our Deposit Direct program for years. As noted above, this client has been utilizing our services since 2011.

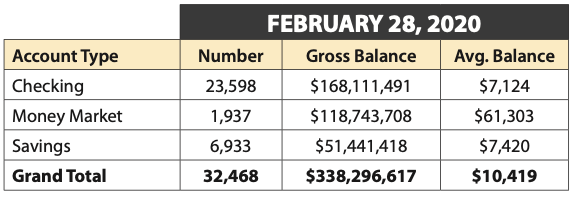

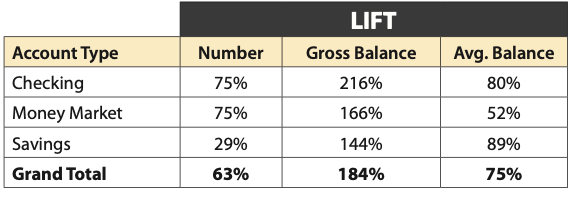

Since beginning our relationship with this client, deposit market share increased by 58% (as reported by the FDIC), though adding new branches and other initiatives are part of that growth as well. More importantly, for the deposit accounts targeted with our program, the growth has been substantial:

Comparing 2011 to 2020 numbers, we have helped this client achieve a 75% growth in core checking accounts. Assuming growth is compounded monthly, that is a 6.9% annual growth rate for all targeted checking accounts. Unless there is heavy investing in acquisitions and new branch openings, most financial institutions show significantly less than 6.9% – with many bordering on flatline growth.

Average balances were also up over that time period. The chart above reflects actual dollar amounts to calculate the 80% lift. However, when adjusting the $3,950 average checking balance with 2020 inflation, that balance would equal approximately $4,631 in today’s dollars. Comparing that to the actual 2020 average checking balance of $7,124, this client still experienced an inflation-adjusted lift in average balance of 54%.

One reason for this increase in average balance was due to the offer at this institution. Instead of offering an incentive for new checking accounts, we focused on rewarding sticky products that help to cement the primary core relationship at the bank (direct deposit and e-statements).

Working with over 1700 clients over the past 19 years has given us the power and knowledge to deliver consistent results for our clients when it comes to driving low cost core deposit growth. Stellar Strategic Group is committed to creating the most effective core deposit strategy to help our clients achieve their long-term growth objectives.