Background

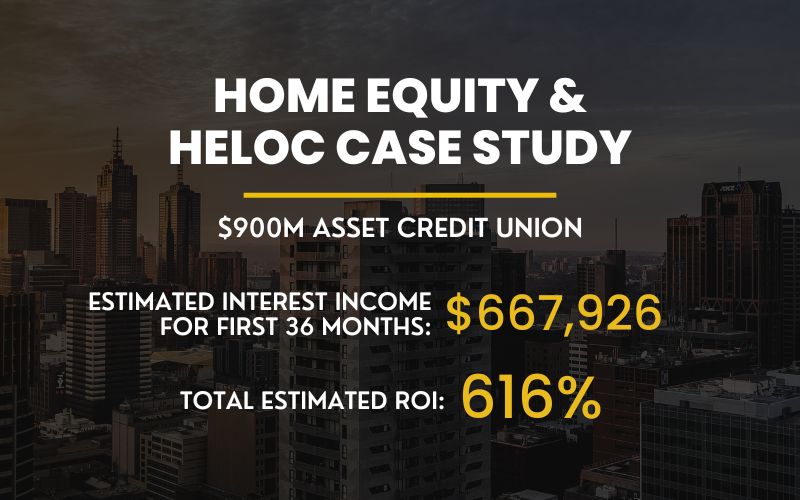

This credit union (CU) is located in the Northeast and has an asset size of roughly $900M with 70,000+ members. The CU has a community charter footprint with a potential membership of several million households.

Stellar Home Equity & HELOC Proposal

Our clients pay no out-of-pocket marketing costs. All incentives, credit bureau lists, mail, postage, telemarketing expenditures, website, etc. are paid by Stellar, thus taking all costly risks from our clients. We collect a 1.75% success fee from the funded loans that match back to the marketed consumers. A $39 application fee is assessed on all applications, which is waived when the loan is funded.

Implementation

Using the CU’s standard rates, the Stellar Home Equity Program targeted member households having home equities of $25,000 or more, with a maximum of 80% Loan-to-Value as collateral.

Members mailed were spread across all paper grades with a FICO floor of 660, using offer rates based on the members’ credit tier. Offers were generated using the credit union’s specific underwriting standards and tailored to that household.

Approach

Stellar’s unique loan generation program uses data mining of credit bureau consumer information to find qualified eligible candidates. Further selection includes targeting members with higher revolving credit, proximity to branches, etc. Stellar then scrubs the potential list to remove those prospects that will not meet the FI’s credit policies (i.e., late payments, bankruptcies, foreclosures, etc.). Prospects are ranked by best responders as well as profitability.

The prospect is mailed a prequalified offer letter, which shows the qualified loan amounts and rates for that consumer if they were to finance with the credit union. The direct mail offer is supported by outbound calls, a custom microsite with an application, reminder letters, digital marketing, and after-hours inbound call service. Applications are completed and sent to the FI for approval and loan closure.

Results

3-Week Member Home Equity Campaign

- Members Targeted: 4,000

- Microsite Applications: 37

- Calls to our call center: 44

- Walk-ins to branches: 36

- Overall Response Rate: 2.93%

- Balance of 32 Funded Applications: $2,447,280

- Average Balance: $76,477.50 per loan

4-Month Member Home Equity Campaign

- Total Members Targeted: 6,749

- $5,3258,580 in new loans

- Average Balance: $65,785 per loan

- Loan ratios: 61% HELOCs and 39% Home Equity loans

- The average blended interest rate for funded loans: 5.7%

ROI

Estimated interest income for first 36 months: $667,926

Total Estimated ROI: 616%