Welcome to the 2022 Winter Edition of Stellar Insights!

As we kick off a new year, we have some very exciting news to share!

The last two years have been a period of explosive growth for our company. As a result, we have invested heavily in technology and the expansion of the solutions we provide our clients. You may have noticed on the front cover of this edition of Stellar Insights, we have changed our name to The Stellar Financial Group. The change was precipitated by the additional solutions we will be offering to our clients going forward. We feel the name change better highlights the goals of our company. We aim to provide a comprehensive approach for our clients to grow their franchise. Our product solutions have always been and will continue to be driven by the needs of our clients. As a privately held company, we are not beholden to anyone other than our clients and their needs.

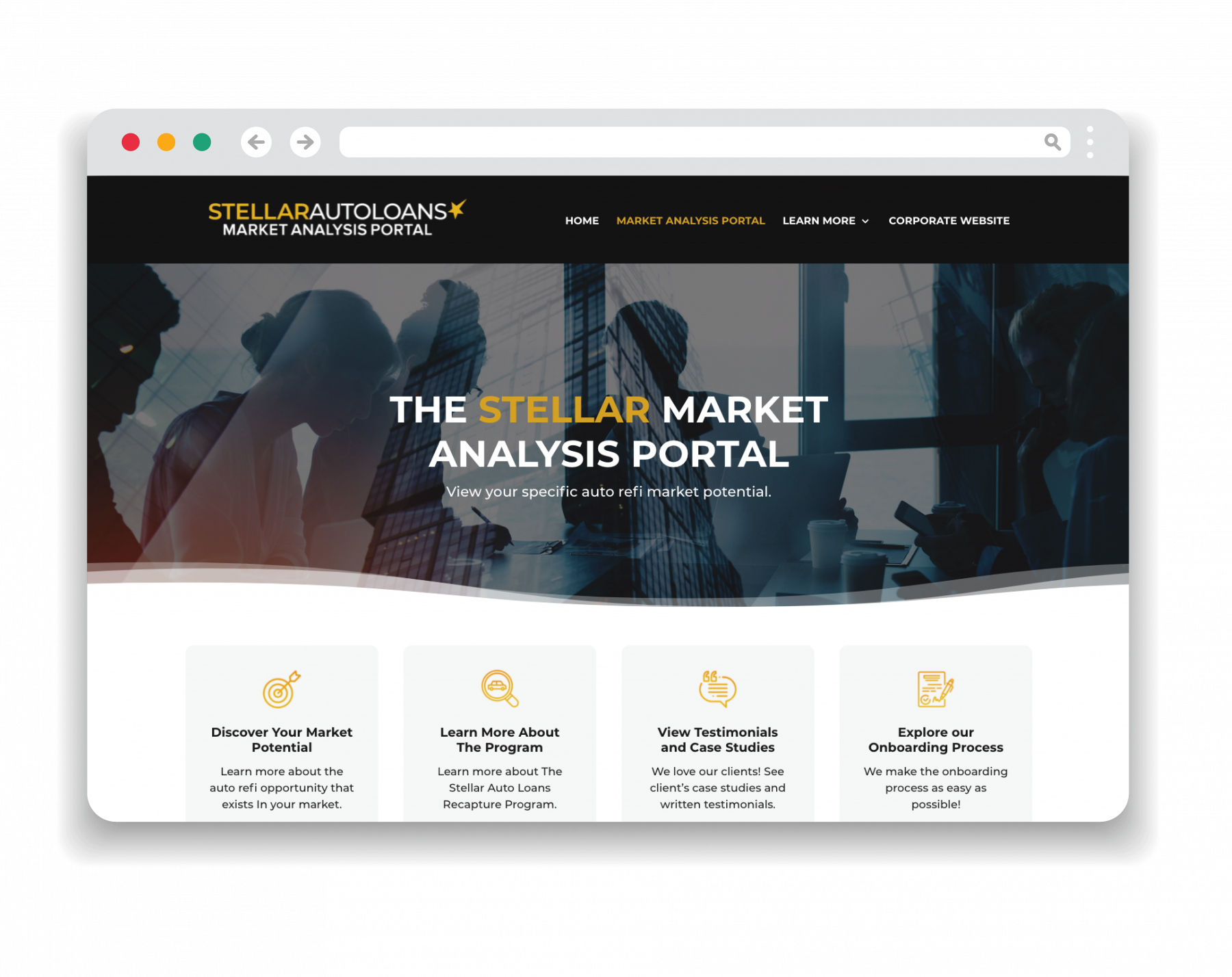

The second piece of exciting news is we have officially launched The Stellar Market Analysis Portal to support our Auto Loan Recapture Program. This portal was developed to assist potential clients with the due diligence and to thoroughly explain our auto loan solution. We like to refer to the portal as a form of window shopping that can be done at the

convenience of our potential clients.

This virtual marketing site allows potential clients the ability to:

- Browse our product solutions

- Pull auto refinance counts specific to their market

- View testimonials and case studies

- Explore the entire onboarding process at their leisure

Now that we’ve gotten the major announcements out of the way, let’s explore more content of this edition of Stellar Insights. As you will see, we focus heavily on what has worked well this past year and what we have planned for 2022. One of the advantages we have had over our 22 years in business is the ability to see how high-performance banking institutions operate year in and year out. The initial goal of this newsletter was to share those experiences.

We’ve incorporated said experiences in our feature article titled Customer Acquisition: A Comprehensive Approach Requires an Offense and a Defense. In addition, we touch on a new opportunity for loan growth, as well as a product influx with a very cost-effective approach to maintaining an important revenue stream without contracts and sharing revenue. I think you’ll find both articles quite thought-provoking.

Here’s to a Happy, Prosperous, and Healthy New Year!

Read More Articles From This Edition

Press Release: New Name, Same Stellar Company

Stellar Auto Loans kicks off the new year by officially becoming The Stellar Financial Group. With this new name change and growth, we will still hold true to our core principle and values. We will continue to provide our lending partners the same great service and results as they have come to know and experience with our organization…..

Stellar’s Auto Loan Recapture Program Q&A

What you need to know about the Stellar’s Auto Loan Recapture Program…

READ MORE

The Overdraft Fee Dilemma & Solution

In short, as this fee became more of a profit center for many, the per occurrence fee continued to inch higher. That rise in fees as well as the structure of these programs has grown to the point that many institutions are reevaluating their policy related to overdraft. This is a result of consumers, regulators, and politicians pushing back on the situation…

The Stellar Market Analysis Portal is LIVE!

We are very excited to launch The Stellar Market Analysis Portal. This virtual marketing site allows potential clients the ability to browse our product solutions, pull auto refi counts applicable to their market, and literally explore the entire onboarding

process, at their leisure…..

Customer Acquisition | Requires an Offense and a Defense

Traditionally, customer or member acquisition was related to securing checking account customers. While that’s still a large component of customer acquisition strategies, it’s still only one of the proven strategies used to acquire new members. In this article, we will explore several components of a comprehensive customer growth strategy. We will also identify which of these strategies will serve as a defensive measure related to customer attrition….

Case Study | $1B Asset Southwest Credit Union

Th is southwest credit union (CU) has an asset size of roughly $1.0B with 80,000 plus members. The CU has a community charter footprint with a potential membership of over several million households….