The Stellar Market Analysis Portal will be RELEASED THIS FALL!

Once the portal is live, just go to MarketAnalysisPortal.com. There will be a simple sign-in process, as the portal is password protected.

Browse Our Product Solutions at Your Convenience

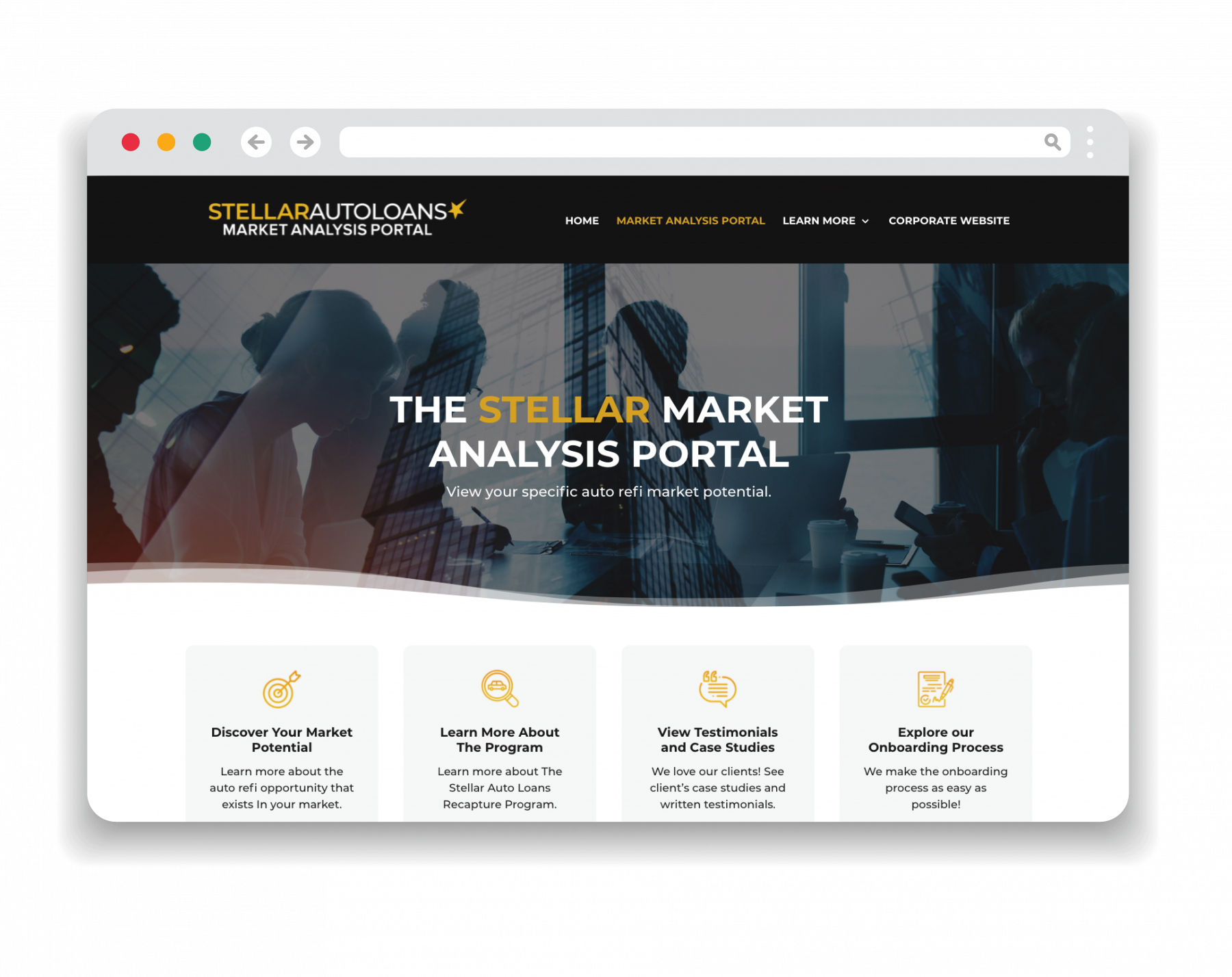

We are very excited to launch The Stellar Market Analysis Portal. This virtual marketing site will allow potential clients the ability to browse our product solutions, pull auto refi counts applicable to their market, and literally explore the entire onboarding process, at their leisure. The portal will essentially eliminate the need to sit and review a PowerPoint presentation to learn more about The Stellar Auto Loan Recapture Program. It’s a form of window shopping that can be done at their convenience.

Explore Your Auto Refi Opportunity at YOUR Leisure

Stellar Auto Loans uses credit bureau information to identify households in specific charter footprints that meet a unique credit criteria profile and that are paying a higher interest rate for their auto loan than they would at another financial institution.

With The Stellar Market Analysis Portal, you will be able to pull your refi counts based on your specific credit criteria. By uploading your rate sheet, you’ll be able to view counts by county, paper grade, monthly savings, etc.

View Testimonials & Case Studies. Explore Our Onboarding Process.

Discover Your Market Potential. Learn More About The Program.

Browse and Review Additional Program Related Information

In addition to being able to pull auto loan counts applicable to your market, here are some of the additional resources available:

- Case Studies

- Testimonials

- Collateral Material

- Learn More about Loan Participations

- Sample Offer Letters

- Stellar’s Proprietary “7 Step Process”

- Onboarding Process Outline

- Online Application Flow

- Call Center Support

- Client Dashboards

- Ability to Schedule a Meeting on Your Time

Read More Articles From This Edition

Welcome to the 2021 Fall Edition of Stellar Insights!

To help our readers plan for the new year, we have written articles for this edition of Stellar Insights that touch on relevant issues and opportunities…

A Missed-Understood Opportunity

One such opportunity that neobanks have had great success with is refinancing student loan debt. Not originating, but refinancing. This is a very misunderstood product that has tremendous potential for those willing to take a serious look at the numbers…

Overdraft and Debit Card Interchange Fees: One Big Concern, One Giant Opportunity

Many banks and credit unions have depended on overdraft fees as a substantial source of fee income. Now, combined with the end of government fee income from pandemic-related programs, such as PPP, what can banking institutions do to make up for their lost revenue?

How Vulnerable is Your Auto Loan Portfolio?

New auto sales have slowed due to the chip shortage needed to complete the manufacturing of many vehicle models. Institutions are looking for ways to make up some of the short falls, looking at different types of auto loan recapture programs…