Welcome to the 2021 Winter Edition of Stellar Insights!

As we start the new year, we find ourselves still dealing with uncertainty due to the pandemic. I think we were all hoping by this time we would be getting back to a sense of normalcy. That’s the bad news.

The good news is that we have all been forced to rethink our business practices and new opportunities have arisen as a result of the pandemic. There always seems to be a silver lining during difficult times if you look hard enough. Our approach as we head into the new year is a feeling of great optimism. I hope that’s your approach as well!

In this edition of Stellar Insights, we are excited to feature several banking professionals that we work with that play a big role in why we are so excited for 2021. This new feature entitled “Key Insights from Industry Experts” will showcase insights from banking professionals Gregg Stockdale of GS CU Consulting, Lisa Bundy of Cargirl, Inc., and Brian Jones from Gravity Lending.

The initial concept of Stellar Insights was to share what we have experienced in working with thousands of banks and credit unions over the past 20 years. Soliciting thoughts from outside our organization takes that initial premise of sharing information and experiences to another level. We encourage you to consider becoming a contributing author to share some of your expertise and experiences.

In addition, we have included an article on what we call “The Stellar Growth Approach.” This was developed by simply paying close attention to our clients that we consider to be “High Performance” institutions.

It’s uncanny how they all seem to look and operate in a very similar manner. Their core approach is how we‘ve developed our product line over time. In this edition, we’ll focus on credit unions. We got big things in the works with our SALcares program. We’re very excited to be involved with our clients in giving back to their communities.

Keeping with the theme of focusing on credit unions, our auto refinancing program’s founding partner, George Monnier, has completed a case study of how direct auto loans are a perfect compliment to your indirect loan volume. This combination of loans will offer a much more profitable and sustainable auto loan portfolio. By the way, you bank executives out there, our Spring Edition will be focused on banks. While both banks and credit unions are similar in many ways, we think it’s important to also address the differences in their business models. To be fair, we flipped a coin to see who went first.

Here’s to the start of what we believe will be a great year to be in the banking business. Stay healthy enjoy this edition of Stellar Insights!

Craig Simmers

Founder

410-990-0172

craig.simmers@thestellarfinancialgroup.com

Read More Articles From This Edition

Featured Article from Brian Jones of Gravity Lending

Gravity Lending set out to offer a vast array of consumer lending products, connecting consumers to lenders for the lowest cost loans for all their lending needs...

READ MORE

Featured Article from Lisa Bundy of CarGirl Capitol

New members only generate income to the credit union while they are members, so attrition must be part of the overall strategy for total growth....

READ MORE

Featured Article from Gregg Stockdale

Then there’s the credit union which has found a strong loan demand…even stronger than the concentration ratio limits would allow for. My advice — NEVER turn off demand…

READ MORE

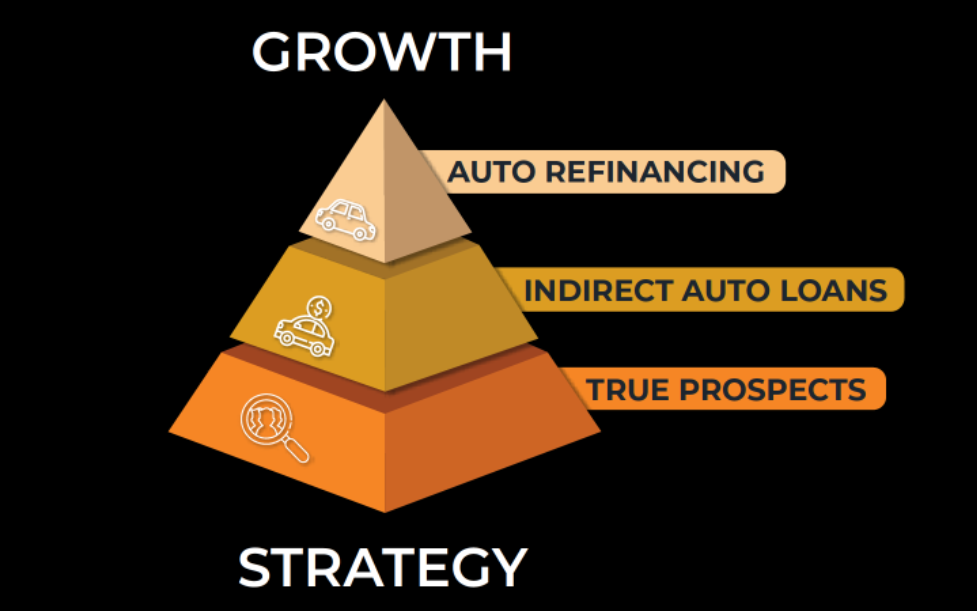

The Stellar Growth Approach

We strongly believe the strategy we’ve built through collaboration with our thousands of clients over time is a basic foundation for growth that can and should be applied by every community institution. We refer to these three basic pillars of growth as The Stellar Growth Approach....

Hot New Member Acquisition Strategy

Loan accounts increase long term profitability and could be used as a new member acquisition growth strategy if well balanced. What do I mean by this? Many credit unions have significant indirect loans based on their dealership relationships....