Auto Participations are HOT, HOT, HOT!!!

Why? Well, several reasons.

One has to do with the demand that is being driven by the high liquidity of most financial institutions and the hunt for low-risk assets that yield a decent premium.

Auto loans have been a great investment as they are deemed a necessity in most economies. While new car prices have risen to levels never seen in the past, the used car market has enjoyed record price highs with little softening on the horizon except for minor seasonal adjustments.

Autos also offer a quicker runoff that allows you to take advantage of a changing market condition and move into new areas when the Fed begins to raise their rates.

The other reason is supply.

Many financial institutions began exiting this avenue either for more higher-yielding assets (commercial, pre-COVID) or due to mergers and consolidations.

The shift was mainly because it was a race to the bottom. With the indirect model, volume is great, but your fate is in the hands of the auto dealers, with them determining who gets the loan based on how it benefits them (such as dealer reserve and rate markup). In some markets, it was just too competitive to cover production and servicing costs.

According to Experian in their State of the Automotive Finance Market Report for Q3 2020, the percentage of loans originated by banks and CU’s decreased while the captive finance increased (see charts below). This further shortened the supply of available auto pools for sale.

New Auto |

Q3 2019 |

Q3 2020 |

Banks |

28.97% |

25.13% |

CU’s |

11.59% |

54.21% |

Captives |

54.21% |

59.08% |

Used Auto |

Q3 2019 |

Q3 2020 |

Banks |

40.69% |

37.83% |

CU’s |

29.42% |

29.08% |

Captives |

8.45% |

11.87% |

So, where does this create opportunity?

Right now, and for the next year, auto pools are going to have more demand than supply, so which one do you choose? Indirect, direct or refinance? Indirect loans can be somewhat unpredictable depending on the market and dealers you work with. As you can see above, the captive finance companies have increased their market share with incentives and dealer requirements.

With direct loans, the new borrower begins a relationship with the institution that can grow depending on how it is nurtured. However, with COVID and social distancing, this becomes more challenging and pushes the borrower to complete the process without much personal interaction. With refinance, the value proposition to the new borrower (savings on reducing their interest rate and lowering their payment) sets the institution up to be one that is saving them money rather than charging it.

That changes the dynamic of the relationship and hopefully starts them thinking of you on their other purchases; as well as you now have their contact info to continue to market with new offers. Another benefit to the refinance model is the fact that refi pools have shorter lives, allowing the quicker runoff in and out of a set rate environment.

If you find yourself with more auto loans than you want to carry on your books, then you can always sell pools to another institution that would like to have these on their balance sheets without having to actually produce the loans.

If you are interested in pursuing buying or selling auto pools, whole or participation, feel free to give Lisa Bundy a call at 904-472-7930 or email her at lisa@cargirlcapital.com.

Read More Articles From This Edition

Stellar Insights Intro

In this edition of Stellar Insights, we are excited to feature several banking professionals that we work with that play a big role in why we are so excited for 2021....

READ MORE

Featured Article from Brian Jones of Gravity Lending

Gravity Lending set out to offer a vast array of consumer lending products, connecting consumers to lenders for the lowest cost loans for all their lending needs...

READ MORE

Featured Article from Gregg Stockdale

Then there’s the credit union which has found a strong loan demand…even stronger than the concentration ratio limits would allow for. My advice — NEVER turn off demand…

READ MORE

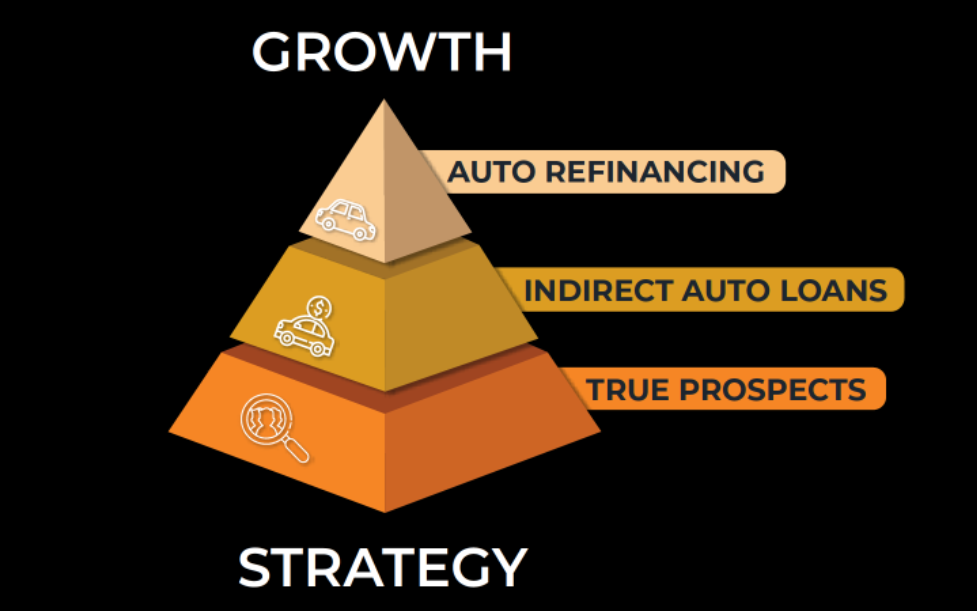

The Stellar Growth Approach

We strongly believe the strategy we’ve built through collaboration with our thousands of clients over time is a basic foundation for growth that can and should be applied by every community institution. We refer to these three basic pillars of growth as The Stellar Growth Approach....

Hot New Member Acquisition Strategy

Loan accounts increase long term profitability and could be used as a new member acquisition growth strategy if well balanced. What do I mean by this? Many credit unions have significant indirect loans based on their dealership relationships....